“Soar”

Looks back a month to compare

Falling without style?

First thing I thought. Even after today, the S&P 500 is down 5% on the month and 10% since Trump took office

This is a dead cat bounce. Nothing fundamentally has changed until Trump is out of office. There is no one talking him down from his bad decision making.

He will move onto the next grift or scandal so he can dominate the next news cycle and make the old one go away. Eventually he will come back to fuck with the economy again.

Rinse & Repeat/Round and round we go until he hits something big he can’t make go away like Covid did in his first term. Then he will loose it.

If you want my bet on what that is, it will be a major war.

He will move onto the next grift or scandal so he can dominate the next news cycle and make the old one go away

This is his life’s work. Way before the presidency.

War, cold war, or trade war? Maybe a mix, like trade war (since that seems to be sticking around) and a proxy war that the US is using to keep the war supply industry rolling (since he had broken all other industries).

Don’t forget plenty of other pandemic potentials, especially since the US officially doesn’t recognize any problems anymore like climate or pollution or science.

Cold War wouldn’t dominate the news cycle enough.

Some say we may be in the opening stages of WW3 so I’m imagining full on war or domestic instability/insurrection.

Of course an unchecked pandemic should always be on anyone’s bingo card moving forward as well.

“Soar” is a strong word when you consider they were higher less than a week ago. Can’t wait for the next thing he says to drop the market before the weekend so his boys can get in on the next pump and dump. He literally tweeted “NOW IS A GOOD TIME TO BUY” right before he paused the tariffs.

It’s the only word journalist know to describe something that isn’t plummeting.

I guess y’all think 90 days is enough time for China to back down and for all of your manufacturing and supply chain to spin up?

He could change his mind on a fart tomorrow.

Farce.

Can’t wait to see the demands for DEI removal from sovereign nations to avoid tariffs. Or more energy blackmail.

🖕

I wouldn’t be surprised if the US moron brigade demands from African nations that they shouldn’t hire black people anymore.

Africa can do itself a favor by expelling all the American Christians that were there writing some of the laws for some of the countries.

China is exempted from the deferral. Theirs will continue to be taxed.

Penguins 1 - USA 0

The market reaction is dumb. 90 days bus very little for companies to adapt when years are needed.

I think this but it’s just the people seeing his tweet immediately before he lifted the restrictions.

Looks like we are still heading for recession and Treasury bills interest is still jumping up.

One part is a reverse game of chicken, buy the dippest dip to realize most profit from less dippy dip buyers.

The other part is the assumption that this means the tariffs will never actually come or at least in a much relaxed form.

The vibe I get is that most elites really don’t want to believe the president could be dumb, because that means they could be too. Elites own and/or work with a lot of stocks, and that extends to their investing decisions.

So they figure, sure, it must just be a 4D chess bluff.

Is anyone else disgusted by the term “elites”? It plays right into the mindset of the wealthy oligarchs, who sincerely believe they’re better than the rest of us.

Such people aren’t “elite,” they’re useless parasites that wouldn’t be able to exist if they weren’t sucking the wealth out of us. It’s time we stop using a term that kisses their asses.

Nobody likes being called an elite, don’t worry.

I’ve started referring to them as the “Problem Class”

And you really think “the elites” are the ones buying and selling here?

Yes, they have a lot of wealth in stocks, but usually they simply own a large chunk of their (or their parents) company and the rest is managed by a fund manager. And if you have millions or billions, you don’t need to think quarter to quarter.

Wealth is a continuum; there’s no actual dividing line, like is commonly thought. But just personally, the posher people I know are less bearish, and it looks like the trend continues once you get even higher. Big fund managers tend to be in the picture. I don’t know off the top of my head how much movement is professionals and how much is retail investors.

I feel the need to disclose that I’m personally short on the US, relative to other markets.

Edit: And I should also mention the myth of meritocracy has a wide following, it’s just extra favoured by the people who would be implied to have merit by it. And there’s the fact that most people came up in a time where this sort of thing never happened, so there’s normalcy bias on top of it all.

and the rest is managed by a fund manager.

This is one area I’m ignorant on that I wish I knew more. How are these daytraders or fund managers avoiding capital gains taxes? When they are liquidating a position as they are selling securities, they are trying to preserve prior gains. At best aren’t they getting hit with 15% capital gains taxes on the sale? If so, the fund manager has to believe they will lose more than 15% to justify the transaction right? Again this is best case assuming they’ve held the security for more than a year. Short term capital gains taxes can be as high as 37%!

I understand folks making these vast swinging trades in their IRA or 401k where they are immune to capital gains, but how are fund managers (or regular retail after tax investors) making these wild swings without being eaten alive by taxes?

You are taxed on the gains, not on the total sale volume.

So if I buy something today for $5, and sell it tomorrow for $6, I pay the 37% on the $1 of gain.

So my takeaway is $5.63, not the $3.78 it would be I was taxed on the full sale.

It’s also worth noting that capital losses can offset gains. So if I made $1000 on one trade, but lost $1000 on another, my effective tax is $0, because I didn’t make any money.

This can get squishy though, as there are a lot of accounting loopholes you can do to count things as “losses” that are more losses on paper than actual losses.

You are taxed on the gains, not on the total sale volume.

You’re right, of course, I didn’t write that well. I’m in for the long term and don’t usually think about the smaller gains usually in short term. For me, even just the long term gains are substantial with the 45%-ish increases in value in the last couple of years prior to trump.

It’s also worth noting that capital losses can offset gains. So if I made $1000 on one trade, but lost $1000 on another, my effective tax is $0, because I didn’t make any money.

I knew this part too, but if a hedge fund/daytrader is doing this enough that their capital losses offset their gains, then they would be a pretty worthless hedge fund manager/daytrader, right?

This can get squishy though, as there are a lot of accounting loopholes you can do to count things as “losses” that are more losses on paper than actual losses.

This is the part I’m ignorant about, I think.

If you’re concerned about that, you might look into index funds. Many are managed to minimize capital gains at a scale that you could never do in personal trading

it must just be a 4D chess bluff.

Many of us hope against all evidence there is some strategic logic here, some actual plan, some intelligence behind the chaos. I’m still in denial that this could happen in the real world ……it’s just a hallucination about some real estate conman

Yeah, that’s the basic attitude I’m thinking of. Normalcy bias feed into it as well as what I mentioned about meritocracy.

I suspect it’s less common in the lower classes because if you’re poor, stability has never been guaranteed, or for that matter even reasonability. There’s no expectation that’s been set. Depending on a person’s roots there might also be cultural memory in there of previous times things went crazy.

deleted by creator

I agree this is just market euphoria. We have a lot of systemic issues that have been exacerbated and/or entirely created by Trump.

The core problem is Trump full stop. He is sitting in the White House with nothing but “Yes” men in his cabinet. It’s only a mater of time until he releases his next scheme on the market.

He’s been obsessed with tariffs all his life, he won’t stop doing those

No he won’t give tariffs up. This was his latest gift to make 10% tariffs on everything seem not so bad. I’m willing to bet 10% was always his goal and the crazy numbers he threw out were there to make 10% seem reasonable.

The problem is after 4 months of attacking allies, siding with dictators, reneging on prior trade agreements he negotiated, and being called out for it globally. This latest economic grift wiped any trust the US had left.

The US is uninvestable while he is in power. You can’t make major investments be it a billion dollar factory complex or some small business importing goods to build a product. You could be wiped out because of a mood swing or Orange Mussolini’s latest grift.

Worse his tariffs put many US manufacturers at a disadvantage compared to foreign competitors. He’s just set the stage for a definite recession, long term slow economic growth or at worse a depression if the bond market fully breaks down.

Even if he can get tax cuts passed they won’t do shit to put it all back together.

I think this but it’s just the people seeing his tweet immediately before he lifted the restrictions.

Market doesn’t know if the tariffs are even coming back, and are taking the chance to buy back low.

He suspended it for 90 days and also previously threatened that there will be more, so we don’t even know if next week there won’t be new tariffs.

It’s still possible that’s the point. Not the tariffs as a goal but as a weapon to hold over everyone’s head, to shake them down until they all bow before mango mussolini

Have we forgotten that he has done this each month since he was Inaugurated?

He crashes the the stock market with talk of tariffs. The wealthy buys options on the decline, and buy on this massive dip, and in a few days, HitlerPig announces that the countries on his list have responded to his tariff threats, so he is postponing them for a month or so.

The stock market recovers a bit, and the wealthy will make fortune. In a month, he’ll do it all over again. This was thebthird cycle since Inauguration.

It’s deliberate market manipulation.

It I not

illegalMarket Manipulation if the president does it

Thos whole thing is so fucking stupid.

Like the majority of muricans

as a 'merican… i feel that

but also I’m Lakota and I’m fucking laughing

deleted by creator

This man is a toddler with a flamethrower having a tantrum.

More like one flamethrower in each hand.

I’m getting really tired of the media misrepresenting reality. Stocks are still down compared to a year ago.

Still down compared to a month ago, but the post was a few days ago where there was one short upward trend for like a couple hours.

deleted by creator

For 90 days, if he can resist changing it again that long.

I’m also pretty confused about how Canada and Mexico fit into this, because they said we’re included in the rollback to 10%, but we weren’t in the original “liberation day” tariffs in the first place.

90 days to save up your hard earned money so you can buy the dip again…and again…and again. This is what the old shit stain is doing.

35% Tarriffs on eu/Asia and 104% Tarriffs on China is still a recession. Other countries arent removing their Tarriffs

The only positive thing this did was show that Trump is weak, so hopefully he’ll stay at these rates and maybe he’ll be out by the end of the year

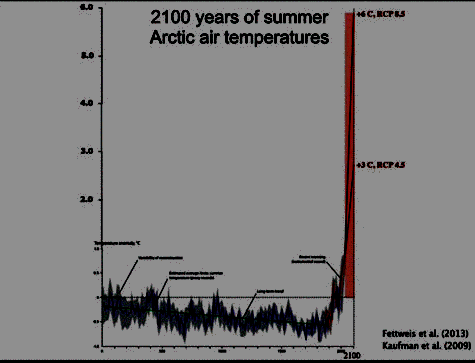

Not specifically directed at OP, but I am sick of those truncated graphs.

Also, fuck Trump. Not in a goof way.

From the article:

The commerce secretary added on X that he and Treasury secretary Scott Bessent “sat with the President while he wrote one of the most extraordinary Truth posts of his Presidency”

Next time I’m feeling down, I’ll just remember that someone felt the need to post on Xitter that he helped Trump write down his best posts on some shit social.

The normalisation of that insane shit is something the mass media has to bear a large portion of the responsibility for.